who pays sales tax when selling a car privately in florida

Who Pays Sales Tax When Selling A Car Privately In Florida. Collect the buyers home state rate up to Florida 6.

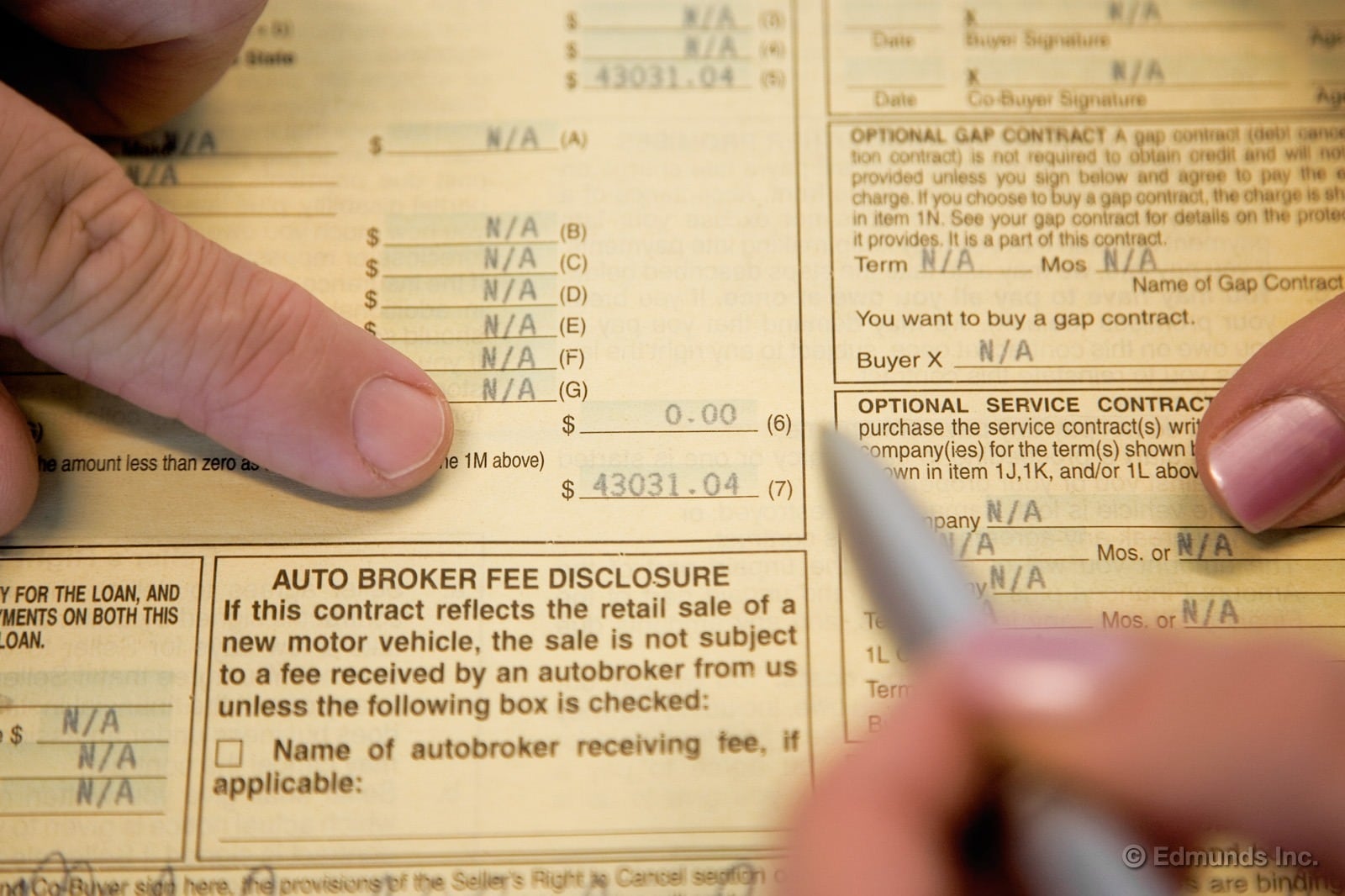

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

Make sure to print legibly and use your full legal name.

. Expect to pay these fees to a motor vehicle service center when transferring ownership. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. You will pay less sales tax when you trade in a car at the same time as buying a new one.

However the seller must sign over the title to the buyer and the buyer must take the appropriate steps to transfer the title into his or her name see Registration Titling. You may voluntarily file and pay taxes electronically. In Florida if you buy a 30k car you would owe 6 which is 1800.

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. If you sell more than two motor vehicles in any. If the title is electronic rather than physical.

Thereafter only 6state tax rate applies. Dealer to collect and report Florida sales and use tax. To calculate how much sales tax youll owe simply multiple the vehicles price by 006625.

The buyer must pay Florida sales tax when purchasing the temporary tag. Check that the VIN appears the same on the title certificate as it does on the vehicle. Thankfully the solution to this dilemma is pretty simple.

To sell the motor vehicle the lien first has to be satisfied. Theres one scenario in which you must be present at an HSMV office to sell a car. According to the Florida Department of Highway Safety its best to complete the transaction at the tax collectors office.

You do not need to pay sales tax when you are selling the vehicle. No local surtax charged. The buyer will have to pay the sales tax when they get the car registered under their name.

In that case youll need to fill out either Form 82994 or 82092 to have the title reassigned in paper format. Additionally Florida law presumes any person firm partnership or corporation that buys sells. If you buy a car for 30000 you would typically owe a six percent sales tax which comes to 1800.

Or private tag agency. Do I have to pay sales tax when I transfer my car title if the car was given to me. Proof of Ownership Buyers should ask to see the title to verify VIN and.

20000 purchase price x 006 sales tax percentage 1200 sales tax owed. An out-of-state dealer who does not have a Florida sales tax number buys a motor vehicle for resale or lease. Bills of Sale are an important part of the sales process and required by law.

Fully executed Form DR-123 must be signed at time of sale. If you get. Florida law prohibits the parking of any vehicle on public right of ways or on private property for the purpose of sale without the permission of the property owner.

The form removes your current registration from the car and also removes your interest and liability attached to the vehicle. Under the Sales Tax Exemption Certification section of the application the new owner is required to declare that the transfer of ownership is exempt from tax as a gift. Sales to someone from a state with sales tax less than Florida.

If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. The local surtax only applies to the 1st 5000. The state bill of sale or Notice of Sale andor Bill of Sale for a Motor Vehicle Mobile Home Off-Highway Vehicle or Vessel Form HSMV 82050 can be downloaded and printed.

If your trade-in is given a value by the dealership of 10k then you would only owe 1200 a savings of 600. Visit the Departments Florida Sales and Use Tax webpage. Its illegal in Florida to sell a vehicle privately with an existing lien.

Again exercise caution when purchasing a used vehicle from a dealer or an individual. Additionally Florida law presumes any person firm partnership or corporation that buys sells. It is legal to buy or sell a vehicle without a registration.

It will need to be complete and then filed with your local county tax collector office. The Bill of Sale form 82050 should be notarized prior to filing. But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit.

This is generally referred to as curbstoning. Doing so protects you from civil liability and other headaches that could occur if. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

6 Provide the buyer with a Bill of Sale. Remember the sales price does not include sales tax or tag and title fees. You will pay less.

However if you pay 20000 or more in sales and use tax between. Florida collects a 6 state sales tax rate on the purchase of all vehicles. The local surtax only applies to the 1st 5000.

How To Sell A Car To A Family Member Is It Better To Sell Or Gift A Car

Car Tax By State Usa Manual Car Sales Tax Calculator

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

20 Frequently Asked Questions About Florida Vehicle Titles Etags Vehicle Registration Title Services Driven By Technology

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

What Percentage Of Used Car Buyers Lie About The Vehicle Purchase Price To Alter The Amount Of Sales Tax Required Quora

20 Frequently Asked Questions About Florida Vehicle Titles Etags Vehicle Registration Title Services Driven By Technology

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

:max_bytes(150000):strip_icc()/162971_VE-ALT_howToSellCar-5a8dd0c4d8fdd50037949800.jpg)

How To Write A Bill Of Sale For A Car

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

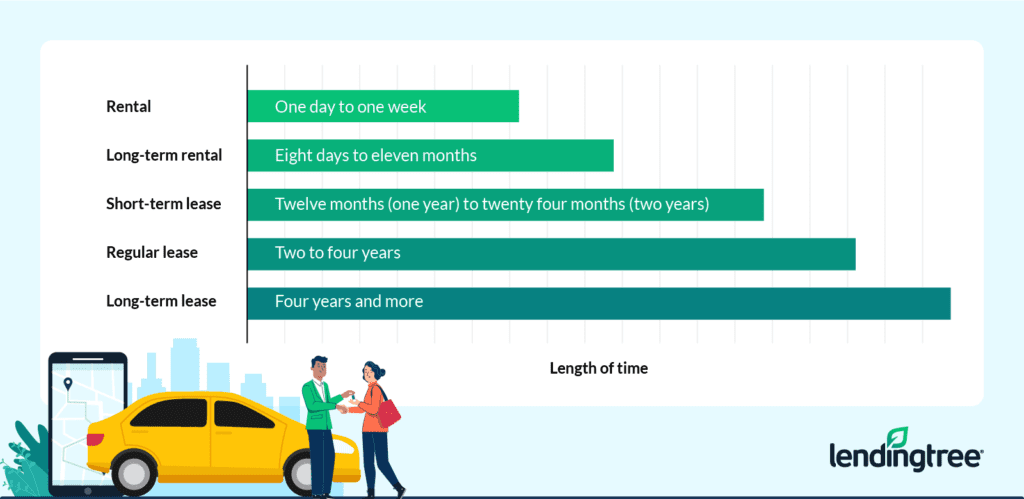

Short Term Car Leases Vs Long Term Car Rentals Lendingtree

Gifting A Car How To Gift A Car To A Family Member Or Sell It For Profit